University Funds Investment Policy

April 25, 2024

To request an official copy of this policy, contact:

The Office of the Governing Council

Room 106, Simcoe Hall

27 King’s College Circle University of Toronto

Toronto, Ontario

M5S 1A1

Phone: 416-978-6576

Fax: 416-978-8182

E-mail: governing.council@utoronto.ca

Website: http://www.governingcouncil.utoronto.ca/

Preamble

The financial assets (“University funds”) of The Governing Council of the University of Toronto (“the University of Toronto” or “the University”) are grouped and managed for investment purposes in two pools: the Long-term Capital Appreciation Pool (LTCAP), which holds endowment funds and other funds held for the long term, and the Expendable Funds Investment Pool (EFIP), which holds the University’s expendable cash. There are also a small number of specifically invested trust funds with investment terms and conditions that preclude their pooling into LTCAP or EFIP.

ROLES

Each of the Governing Council, the Business Board, and the President or designate have roles, as outlined in the Business Board Terms of Reference, with respect to investment of University funds.

The Business Board of Governing Council is responsible for:

- Financial policy, including policy delegating financial authority, and approval of financial transactions as required by the policy. With respect to investments, these responsibilities are further delineated as follows:

- Review and approval from time to time of the investment policies for university investment funds and amendments thereto.

- Review and approval from time to time of the return targets and risk tolerances for the investment of the University funds.

- Review from time to time of the asset allocation for the investment of University funds.

- Review of annual reports or more frequent reports as the Board may from time to time determine on the investment of University funds, such reports to include, without limitation: (i) reports on investment risk and return; and (ii) reports on fees and expenses incurred.

- Approval of the delegation of authority to a University-controlled asset management corporation (or other entity established for a similar purpose) for the management of the investment of University funds.

The President of the University or designate is responsible for:

- With the advice of the Investment Committee, approval of asset allocation for the University funds.

- Negotiation and settlement of a detailed investment management agreement between the University and a University-controlled asset management corporation, pursuant to the approved delegation of authority to the corporation (or other entity) for the management of University funds.

Such of the funds invested in LTCAP and/or EFIP that the University desires to have invested by the University of Toronto Asset Management Corporation (“UTAM”), together with a small number of specifically invested trust funds, are invested by UTAM on behalf of the University in accordance with the Delegation of Authority from the University to UTAM and in accordance with an investment management agreement between the University and UTAM. UTAM, which was formed in April 2000, is a separate non-share capital corporation whose members are appointed by the University of Toronto. Its primary mandate is to manage, or see to the management of, the investment funds that are delegated to it by the University of Toronto.

The Investment Committee reports to the President of the University and provides expert advice to the University Administration, collaborating extensively with the University Administration and with UTAM management on investment objectives and investment activities. The Investment Committee approves proposals from UTAM management staff for execution of investment strategy, and provides monitoring and oversight of investment performance. The Investment Committee recommends investment risk and return objectives to the University Administration. Its concurrence is sought by the President in proposing risk tolerance and investment return targets which are then put forward for approval by governance.

RISK TOLERANCE AND RETURN TARGETS

This policy specifies the risk tolerance and investment return targets for LTCAP and EFIP, which are operationalized by the President of the University or designate.

Long-term Capital Appreciation Pool (“LTCAP”)

The Long-term Capital Appreciation Pool is a unitized fund which pools, for investment purposes, the University’s endowed trust funds along with some other funds of a permanent or long-term nature. In addition, small amounts of external funds may be invested in LTCAP in those situations where the University is a beneficiary. The purpose of LTCAP is to generate investment returns net of all investment fees and expenses that will preserve purchasing power and provide the same or better level of support for future generations of unit holders as those provided today.1 This necessitates a balance between the desire to reward unit holders in the present and a long-term view toward developing a sustained or increasing spending allocation from these funds.

In order to meet planned spending allocations to LTCAP unit holders, the investment return target is a real investment return of at least 4.0% over 10-year periods, net of all investment fees and expenses, while taking an appropriate amount of risk to achieve this target, but without undue risk of loss.

The return target and risk tolerance are operationalized by the President of the University, with input from the Investment Committee, through the President’s approval of LTCAP’s asset allocation and the investment management agreement between the University and UTAM. Asset allocation is defined as the division of a portfolio’s assets among a variety of asset classes in accordance with long-term policy goals and includes ranges, restrictions and limitations of various kinds on investments. Currently, the President does so, with input from the Investment Committee, by establishment of a passive policy portfolio, known as the Reference Portfolio, together with limits, ranges and restrictions, including those with respect to risk, allocation ranges, currency exposures, and liquidity. Taken together, these are viewed as being sufficiently large to permit

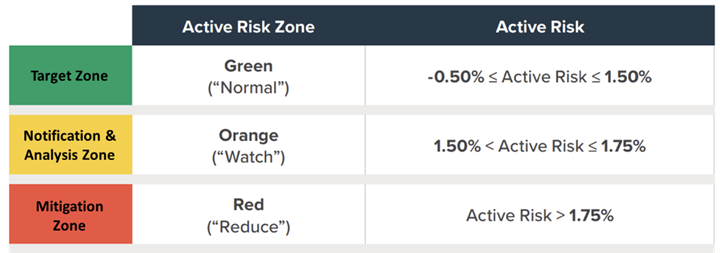

UTAM management the flexibility to achieve its value-added objective but not so large as to put the portfolios at undue risk of significant underperformance relative to the Reference Portfolio. The Reference Portfolio provides a means of comparing the outcomes of passive management of investments, to an allocation that is made pursuant to an active management approach, which is the approach currently used by UTAM. The Reference Portfolio, as with any portfolio, includes a level of risk, which for the purposes of this policy is currently defined as volatility. The asset allocation in the Reference Portfolio includes a level of volatility risk that is viewed as appropriate to the nature of the LTCAP. Since active management also includes a level of volatility risk, three zones of active risk are identified, with a target zone (green), a zone that requires notification and analysis (orange), and a zone that requires mitigation steps (red). This can be described as a “traffic light” risk framework approach.

1 The University’s Policy for the Preservation of Capital of Endowment Funds identifies the need to maintain the inflation- adjusted value of endowment capital; and the need to provide a stable flow of expendable income for the purposes of each fund.

This approach is described in more detail in the following narrative and table:

The Reference Portfolio represents a simple, low-cost, passive portfolio which is believed to be appropriate to LTCAP’s long-term horizon and associated return and risk profile. By design, the Reference Portfolio is not exposed to active management decisions and thus is expected to be reviewed only periodically. Given the current environment, it is believed that the Reference Portfolio may have difficulty achieving the 4% real return objective and therefore successful active management decisions need to be implemented to achieve the return objective. The Reference Portfolio provides a transparent replicable benchmark against which to compare an active management approach, although over shorter periods of time the Reference Portfolio’s real return may deviate from the longer term expectation. Given the decision to allow an active management approach, it is prudent to establish an LTCAP-level risk limit within which UTAM has discretion to make and implement investment decisions with the objective of earning returns above the Reference Portfolio. This LTCAP-level risk limit is defined as the volatility of the Reference Portfolio plus an additional amount of active risk. Active risk is defined as the volatility of the actual portfolio minus the volatility of the Reference Portfolio. The table below outlines the current “traffic light” risk framework.

The President, pursuant to his approval authority, and with the advice of the Investment Committee, may periodically revise the active risk framework (including, without limitation, the “traffic light” risk framework and the definition of active risk), while ensuring that the total risk in LTCAP is consistent with the risk tolerance and investment return targets identified in this policy.

UTAM will provide a periodic investment performance report to the Business Board not less frequently than annually that will compare actual investment results for LTCAP to the risk tolerance and investment return targets, and to the Reference Portfolio results.

Expendable Funds Investment Pool (“EFIP”)

The Expendable Funds Investment Pool (“EFIP”) contains expendable funds that are pooled and invested until spent. It includes the University’s unspent cash from operations, capital projects, ancillary operations, expendable donations, expendable payouts from endowments, and research grants.

EFIP is composed of:

- Short-term funds held by the University to meet operational cash flow needs within three months;

- Short-term and medium-term portfolios managed by UTAM; and

- Long-term funds invested by the University in internal loans.

The amounts allocated to short-term, medium-term and internal loans are determined annually based on the EFIP balances at April 30, as follows:

- 45% is allocated to the short-term category, representing funds available to be spent on a short-term basis, with an investment strategy reflecting an investment horizon of less than 3 years, and with any intra-year fluctuations in the total EFIP balance to be allocated to the short-term category. Additionally, funds allocated to medium and long-term investments, which have not yet been invested, will also be invested in the short-term category. Within the short-term category, funds required for operational cash flow needs within three months are held by the University, and the remaining balance is invested by UTAM.

- 30% is allocated to a medium-term portfolio to be managed by UTAM, representing funds that are not expected to be spent in the short-term, with an investment strategy reflecting an investment horizon of about 3 to 5 years.

- 25% is allocated for the long-term, representing funds that are expected to be used for internal loans (mostly long-term loans with terms of 25 years) under the University’s internal borrowing programme.2 Funds provided to the University that have restricted terms for their use are not invested in long-term investments, but are invested in short and medium term portfolios.

2 The University’s Debt Strategy, amended by the Business Board in 2023, permits up to 40% of EFIP to be used for longer- term loans under the University’s internal borrowing programme.

The investment return targets and risk tolerances are as follows:

|

Investment Return Objective |

Risk Tolerance |

Asset Allocation |

|

|

Short-term Investments – managed by U of T to meet cash flow needs within 3 months |

30 day T-bill return |

Minimal risk. |

University Administration shall establish investment mandates and select investment vehicles. |

|

Short-term portfolio – managed by UTAM |

50% Canadian Overnight Repo Rate Average (CORRA) + 10bps; plus 50% FTSE short-term Universe |

Minimal risk. |

University Administration shall approve the asset allocation. UTAM shall implement investment strategy in accordance with its mandate. |

|

Medium-term portfolio – managed by UTAM |

FTSE Corporate BBB Index |

Low risk of losses over a 3 to 5 year period (i.e., avoidance of permanent capital impairment) with mark-to-market fluctuations tolerated over shorter time horizons. |

University Administration shall approve the asset allocation. UTAM shall implement investment strategy in accordance with its mandate. |

|

Long-term investments in Internal loans under the University’s internal borrowing programme |

Appropriate spread of Government of Canada bonds of similar duration |

Minimal risk. |

University Administration shall issue internal loans using EFIP funds, or using externally borrowed funds, in accordance with the Business Board-approved Debt Strategy. |

For EFIP funds managed by UTAM, portfolio diversification, categories and subcategories of investments and investment restrictions and other elements of investment strategy will be recommended by UTAM to the University Administration for approval. UTAM will provide a periodic investment performance report to the Business Board no less frequently than annually with respect to EFIP investment results.

Specifically Invested Trust Funds

The assets of specifically invested trust funds shall be invested to adhere to the investment requirements specifically imposed on the University by contractual agreement, whether by a donor, by condition of an estate, or by external administrative arrangement.

General

CONFLICT OF INTEREST GUIDELINES

Anyone involved directly or indirectly with the investment of University funds (“the Affected Persons”) shall promptly declare any actual or perceived conflict of interest that could be reasonably expected to impair, or

could be reasonably interpreted as impairing, his/her ability to render unbiased and objective advice to fulfill his/her responsibility regarding the investment of University funds. Declarations shall be made to the next level of accountability (e.g. depending on the circumstances, and without limitation, to the supervisor, UTAM President, University of Toronto President, Business Board Chair, or Chair of Governing Council).

Any such disclosure shall include, but is not limited to, any material ownership of securities, or any material ownership of any kind, either by an Affected Person or a member of the Affected Person`s immediate family, which could impair, or could reasonably be viewed as impairing, their ability to render unbiased advice, or to make unbiased decisions affecting the investment of the University funds. For clarity, financial interests that are in the ordinary course of personal affairs, and that are not reasonably viewed as material, fall outside the disclosure obligation. If the Affected Person has any doubt as to whether a conflict of interest may exist, including whether a particular interest may reasonably be viewed as material, disclosure should be made.

Further, no Affected Person shall make any personal financial gain (direct or indirect) because of his or her fiduciary position. However, normal and reasonable fees and expenses incurred in the discharge of their responsibilities are permitted upon notification in advance and in writing to the University.

No Affected Person shall accept a gift or gratuity or other personal favour, other than one of nominal value, from a person with whom the Affected Person deals in the course of performance of his or her duties and responsibilities regarding the investment of University funds.

No Affected Person who has or is required to make a disclosure as contemplated in this policy shall participate in any discussion, decision or vote relating to any proposed investment or transaction in respect of which he or she has made or is required to make a disclosure.

CUSTODY

The University Administration appoints the custodian and delegates operational oversight of the custodian to UTAM. The custodian/trustee will:

- Maintain safe custody over the University funds.

- Execute the instructions of the University, of UTAM and of the investment managers.

- Record income and provide monthly financial statements to the University and to UTAM as required.

- Meet with the University and UTAM as required.

Trevor Rodgers, Chief Financial Officer

April 25, 2024